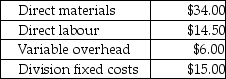

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

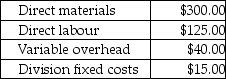

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division.The Compressor Division's operating income is

Definitions:

Durability

The ability of a product or material to withstand wear, pressure, or damage, maintaining its original form and functionality over time.

Barriers to Entry

Factors that make it difficult for new competitors to enter a market, protecting existing players from potential new entrants.

Timmons Model

A framework for understanding and analyzing the entrepreneurship process, focusing on the opportunity, team, and resources.

Timmons Model

A framework for understanding and developing the entrepreneurial process, emphasizing the importance of opportunity recognition, team, and resources.

Q15: The domestic production activities deduction of a

Q36: Easton Ltd. is considering investing in a

Q43: Each of the members of a Federal

Q54: The accrual accounting rate of return is

Q65: Stanford Ltd. purchases 1,600,000 units of its

Q88: Keep Corporation joined an affiliated group by

Q96: In all cases, the "residence of seller"

Q99: The manufacturing manager of New Technology Company

Q112: What is the transfer price per pair

Q115: Shirt Company wants to purchase a new