Answer the following question(s) using the information below.

Cool Air Ltd. manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $77. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.

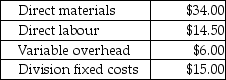

Compressor's costs per compressor are:

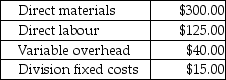

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-If the Assembly Division sells 1,000 air conditioners at a price of $750.00 per air conditioner to customers, what is the operating income of both divisions together?

Definitions:

Vertical Transfer

The application or generalization of skills, knowledge, or attitudes acquired in a learning situation to a different context that requires higher-order understanding or performance.

Horizontal Transfer

The movement or sharing of skills, knowledge, or technologies across different departments or units within the same organizational level.

Organizational Performance

A measure of how well an organization achieves its goals and objectives, often evaluated through financial, operational, and strategic metrics.

Organizational Effectiveness

Measures how successfully an organization achieves its mission and objectives through efficient resource utilization.

Q32: How many deliveries will be required at

Q64: The following information has been gathered for

Q69: Johnson's Mini Mart is considering the purchase

Q70: U.S. individuals who receive dividends from foreign

Q79: In establishing performance measures and compensation policy,

Q87: What is the Refining Division's operating income

Q95: What is the nominal rate of return

Q103: The demand for Ballard's Glass Company's products

Q129: The choice of a transfer-pricing method has

Q137: A "U.S. shareholder" for purposes of CFC