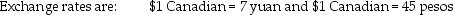

Hendricks Ltd. of Calgary manufactures and sells computers. The Manufacturing Division is located in China and transfers 75% of its output to the Assembly Division in the Philippines. The balance of the product is sold in the local market at 2,100 yuan/unit. The Philippines division sells 20% of its output in the local market at 31,500 pesos/unit, with the balance shipped to Calgary. The Calgary operation packages the units and sells the final product at $1,900 Canadian per unit.

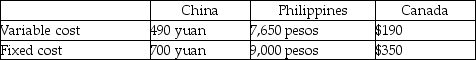

The following budget data are available:

Tax rates are 45% in China, 20% in the Philippines and 40% in Canada. Income taxes are not included in the calculation of cost-based transfer prices. Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions. Take each calculation to 2 decimal places.

Tax rates are 45% in China, 20% in the Philippines and 40% in Canada. Income taxes are not included in the calculation of cost-based transfer prices. Assume that Hendricks does not pay Canadian tax on amounts already taxed in foreign jurisdictions. Take each calculation to 2 decimal places.

Required:

The company has determined that it may transfer units at 250% of variable cost or at market and comply with all existing tax legislation. Which transfer pricing method should the company pursue? Support your recommendation with appropriate calculations.

Definitions:

Thermodynamic Condition

Refers to the parameters of temperature, pressure, volume, and quantity of matter present during a system at equilibrium or undergoing a process that changes its state.

Major Products

Refers to the substances that are produced in the highest quantities in a chemical reaction, often of major interest or value.

Electronegative

Term describing an atom's ability to attract and hold electrons, often used to predict the nature of chemical bonds.

Dipole Moment

A measure of the separation of positive and negative charges in a molecule, indicating its polarity.

Q1: WaterCo, a domestic corporation, purchases inventory for

Q27: Department A charges Department B $1,350 for

Q40: What would be the monthly operating advantage

Q44: When the vendor division receives full cost

Q62: Projects with shorter paybacks always generate more

Q93: In computing consolidated taxable income, the profit/loss

Q107: In a time of distress prices, which

Q115: Goolsbee, Inc., a domestic corporation, generates U.S.-source

Q119: Corporate reorganizations can meet the requirements to

Q131: ParentCo purchased 100% of SubCo's stock on