Use the information below to answer the following question(s) .

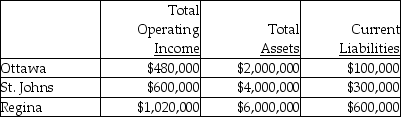

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) . The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for St. Johns?

Definitions:

Release

A promise not to sue or press a claim, or a discharge of a person from any further responsibility to act.

Neurological Disease

A condition affecting the nervous system, including the brain, spinal cord, and nerves.

Specific Performance

A legal remedy that requires a party to perform a specific act, often the fulfillment of a contract, rather than simply paying damages for failing to fulfill it.

Condition Precedent

A condition in a contract that must be met before a party's obligation becomes due.

Q28: In corporate reorganizations, an acquiring corporation using

Q64: Twelve unrelated U.S. persons own a foreign

Q67: A trigger point is defined as<br>A) a

Q85: Economic value-added is after-tax operating income minus

Q95: Cost systems with an exclusive period-by-period focus

Q100: How must the IRS collect the liability

Q103: ParentCo owned 100% of SubCo for the

Q106: Team incentives encourage cooperation by<br>A) forcing people

Q118: When substantially all of the assets of

Q126: Museum Corporation uses the investment centre concept