Answer the following question(s) using the information below:

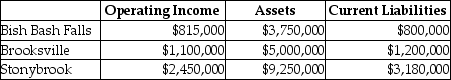

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million) . Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Bish Bash Falls?

Definitions:

Replacement Cost

The expense of replacing an asset at its current market price.

Net Realizable Value

The estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation.

Restricted Fund

Funds that are designated for a specific purpose by the donor or governing authority, limiting their use by the recipient organization.

Investment Income

Income received from investments, including dividends, interest, rental income, and capital gains.

Q6: Hiroshima Inc. is evaluating 3 investment alternatives.

Q14: If the net present value analyses of

Q37: The differential approach calculates the present value

Q50: A part of a control system that

Q65: What are the tax savings in year

Q66: Without evidence to the contrary, the IRS

Q98: All members of an affiliated group have

Q107: Saturn Ltd. wants to automate one of

Q109: Capital budgeting emphasizes the role of financial

Q128: Fabian Company is considering the purchase of