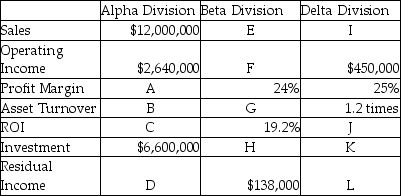

The following table presents information related to three divisions of Bacchus Ltd.:

The company's required rate of return is 10%.

The company's required rate of return is 10%.

Required:

Solve for the unknowns.

Definitions:

Zero-Coupon Bonds

Bonds that do not pay periodic interest payments and are instead issued at a substantial discount to their face value, with the face value being paid at maturity.

Price Volatility

The degree of variation in the price of a financial instrument over a certain period, indicating the risk or stability of the asset.

Treasury Notes

Medium-term interest-bearing securities issued by the U.S. government with maturity periods typically between 1 and 10 years.

Commercial Paper

A short-term, unsecured promissory note issued by corporations with high credit ratings to fund immediate operational needs.

Q2: When an affiliated group elects to file

Q16: How do the Federal consolidated return requirements

Q43: Carter Ltd. is considering purchasing a new

Q50: A C corporation must leave the consolidated

Q54: The nominal rate of return is the

Q70: Sally and her mother are the sole

Q79: Which of the following plans should be

Q84: On March 1, Cream Corporation transfers all

Q101: A management control system should have all

Q109: What is the balance in the Class