Use the information below to answer the following question(s) .

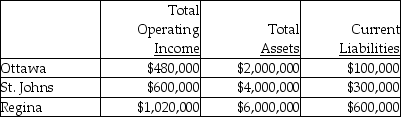

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) . The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for Ottawa?

Definitions:

Capital Balances

The amount of money each partner has invested in a partnership or the equity value in partnerships' accounts.

Statement Of Partners' Equity

A financial document that shows changes in the ownership interest of partners in a partnership over a period of time.

Total Capital

The sum of a company's debt and equity, representing the funds used to finance its operations and growth.

Partnership

Business operation legally established for dual or multiple partners to govern and split profits.

Q8: A decentralized organizational structure may result in

Q23: USCo, a domestic corporation, has worldwide taxable

Q26: The only criticism of team-based compensation is

Q31: An appropriate transfer price is one that

Q35: To be part of a Federal consolidated

Q44: Corry Corporation manufactures filters for cars, vans,

Q63: Which of the following is not generally

Q112: What is the transfer price per pair

Q113: A present value analysis is beneficial when

Q131: Just-in-Time (JIT) Production is a system in