Use the information below to answer the following question(s) .

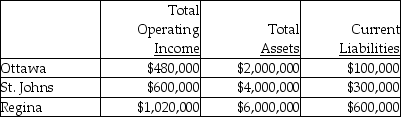

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) . The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for St. Johns?

Definitions:

Imprinting

Learning to make a particular response to only one type of animal or object.

Sexual Selection

Changes in males and females, often due to male competition and female selectivity, leading to increased fitness.

Natural Selection

Mechanism of evolutionary change caused by environmental selection of organisms most fit to reproduce; results in adaptation to the environment.

Fixed-Action Pattern

A fixed-action pattern is a sequence of unlearned, innate behaviors that is triggered by a specific stimulus and is carried to completion once started.

Q6: For consolidated tax return purposes, goodwill is

Q17: What is the net present value of

Q75: Mars Corporation merges into Jupiter Corporation by

Q76: The excess present value index is<br>A) the

Q101: Amber, Inc., a domestic corporation receives a

Q103: Subunit managers are better informed about their

Q118: When substantially all of the assets of

Q131: ParentCo purchased 100% of SubCo's stock on

Q132: Ethical behaviour on the part of managers,

Q143: SubCo sells an asset to Parent at