Answer the following question(s) using the information below:

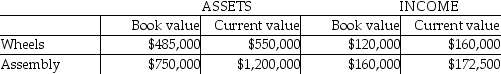

Carriage Ltd.manufactures baby carriages.The company has two divisions, Wheels and Assembly.Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures.The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's residual incomes based on current values, respectively?

Definitions:

Asset Approach

A valuation method that estimates a company's value based on the total value of its assets minus its liabilities.

Liability Approach

A method in accounting that emphasizes recording all financial liabilities at their current value to ensure accurate financial reporting.

Deferred Income Tax Asset

A financial statement item that refers to taxes that have been accrued but not yet paid, which is considered a company asset because it indicates future tax payments that are lower than the current tax expense.

Income Before Taxes

A financial measure indicating the profitability of a company before accounting for income taxes.

Q37: Endicott Inc. has four divisions. Each division

Q45: Costs recognized in particular situations that are

Q51: A company's General Ledger recorded sales of

Q59: The "Type A" corporate reorganization can run

Q75: Mars Corporation merges into Jupiter Corporation by

Q81: Outline the major advantages and disadvantages of

Q89: Which of the following is False concerning

Q117: Wood, a U.S. corporation, owns Holz, a

Q129: The choice of a transfer-pricing method has

Q138: What is the market-based transfer price per