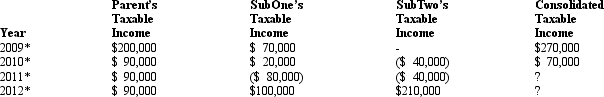

The group of Parent Corporation, SubOne, and SubTwo has filed a consolidated return since 2010. The first two entities were incorporated in 2009, and SubTwo came into existence in 2010 through an asset spin-off from Parent. Taxable income computations for the members are shown below. None of the group members incurred any capital gain or loss transactions during 2009-2012, nor did they make any charitable contributions.

Describe the treatment of the group's 2011 consolidated NOL. Hint: Apply the offspring rule.

* Consolidated return year.

* Consolidated return year.

Definitions:

Rate of Inflation

The velocity at which the cumulative price level of goods and services elevates, thereby diminishing the purchasing capability.

Cyclical Unemployment

Unemployment caused by the cyclical trends in the economy, typically increasing during recessions and decreasing during periods of economic growth.

Overall Unemployment Rate

The amount of the workforce that remains unemployed and is actively on the lookout for employment.

Cyclical Unemployment

Unemployment that results from economic downturns or recessions, characterized by a lack of demand for goods and services.

Q3: Under certain circumstances, a distribution can generate

Q12: National Can Company has three divisions, Eastern,

Q12: Cardinal Corporation has 1,000 shares of common

Q15: Thomas transfers cash of $160,000 to Grouse

Q26: Reginald and Roland (Reginald's son) each own

Q26: The only criticism of team-based compensation is

Q27: In a not essentially equivalent redemption [§

Q37: Any loss in current E & P

Q65: The tax treatment of corporate distributions at

Q66: A subsidiary corporation is liquidated at a