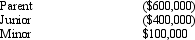

The Philstrom consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Minor.

Definitions:

Profit-maximizing

The process of identifying the output level at which a business can achieve the highest possible profit.

Cost Data

Information related to the expenses incurred in the production, operation, or provision of services, used for analysis and decision-making purposes.

Demand Data

Information on the quantity of a product or service that consumers are willing and able to purchase at various prices during a certain period.

Profit-maximizing

The approach a corporation takes to ascertain the price and quantity of output that yields the maximum profit.

Q44: During the current year, Goose Corporation sold

Q50: A C corporation must leave the consolidated

Q60: An example of an intercompany transaction is

Q70: Property distributed by a corporation as a

Q70: The costs of decentralization include all of

Q71: Which of the following statements is true

Q84: Sportswear Ltd. manufactures socks. The Athletic Division

Q95: Olaf, a citizen of Norway with no

Q111: A product may be passed from one

Q139: Which of the following transactions, if entered