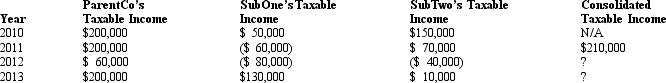

ParentCo, SubOne and SubTwo have filed consolidated returns since 2011. All of the entities were incorporated in 2010. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  How should the 2012 consolidated net operating loss be apportioned among the group members?

How should the 2012 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Womb

The organ in female mammals where offspring are conceived and in which they gestate before birth; the uterus.

Fetal Alcohol Syndrome

A condition in a child that results from alcohol exposure during the mother's pregnancy, causing growth problems, facial deformities, and neurodevelopmental issues.

Facial Characteristic

Distinctive features of a person’s face, such as shape, expressions, and proportions, that identify individual traits.

Maternal Cocaine Use

The consumption of cocaine by a pregnant woman, which can have harmful effects on the fetus, including developmental issues and birth defects.

Q18: Hickman, Inc., a U.S. corporation, operates an

Q25: The president of Silicon Company has just

Q42: To qualify a partial liquidation under the

Q57: Which of the following statements is incorrect

Q71: Discuss the influence of step transaction, sound

Q75: One reason companies use full-cost transfer pricing

Q80: Companies may approach tax authorities to obtain

Q91: When industry has excess capacity, market prices

Q104: A partial liquidation cannot result in sale

Q142: Dark, Inc., a U.S. corporation, operates Dunkel,