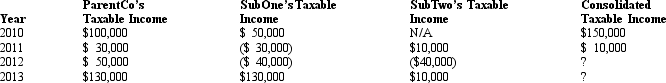

ParentCo and SubOne have filed consolidated returns since 2008. SubTwo was formed in 2012 through an asset spin-off from ParentCo. SubTwo has joined in the filing of consolidated returns since then. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2012 net operating loss, how much of the 2012 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2012 net operating loss, how much of the 2012 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Group Development

Describes the stages (forming, storming, norming, performing, and adjourning) through which groups pass as they evolve and mature.

Stage

A specific phase or period in a process of development or progression.

Cognitive Dissonance

The mental discomfort experienced by an individual who holds two or more contradictory beliefs, ideas, or values at the same time.

Group Support

The assistance, encouragement, and backing provided by group members to each other.

Q12: The Production Division has no alternative use

Q15: The domestic production activities deduction of a

Q30: What is the value of the total

Q31: The consolidated tax return regulations use "SRLY"

Q37: Any loss in current E & P

Q60: Tracy and Lance, equal shareholders in Macaw

Q73: An exchange of common stock for preferred

Q93: In applying the stock attribution rules to

Q99: The Philstrom consolidated group reported the following

Q131: KeenCo, a domestic corporation, is the sole