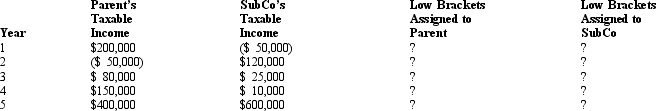

Parent Corporation owns 100% of the stock of SubCo, and the two corporations file a consolidated tax return. Over a five-year period, the corporations generate the following taxable income/(loss). Indicate how you would assign the taxpayers' low marginal rates that apply to the group's first $75,000 of taxable income. Explain the rationale for your recommendation.

Definitions:

Ineffective Sexuality Pattern

A nursing diagnosis referring to disruptions in sexual behavior or satisfaction.

Physical Abuse

The infliction of bodily harm or injury on another person, often a pattern of behavior in domestic violence or child abuse cases.

Compromised Human Dignity

A condition where an individual's sense of self-respect and worth is diminished, often due to treatment received by others or situational factors.

Prostate Surgery

A medical procedure performed to treat conditions affecting the prostate gland, such as prostate cancer or benign prostatic hyperplasia.

Q9: Federal income tax paid in the current

Q24: Discuss the tax consequences associated with a

Q34: When computing E & P, an adjustment

Q39: Gera owns 25,000 shares of Flow Corporation's

Q40: Debt security holders recognize gain when the

Q61: The _ provides a restriction on the

Q83: Crush Company makes internal transfers at 180%

Q98: The Coffee Division of Canadian Products is

Q108: ParentCo and SubCo had the following items

Q127: If a company is a multinational company