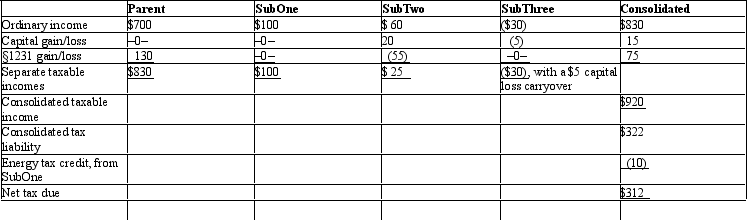

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that the members all have consented to use the relative taxable income tax-sharing method. Dollar amounts are listed in millions, and a 35% marginal income tax rate applies.

Definitions:

Deductive Reasoning

The deduction of a final thought through the combination of several premises that are ordinarily seen as legitimate.

Protects Health

Actions or behaviors undertaken to guard against illness and maintain physical and mental well-being.

Attitudes

A settled way of thinking or feeling about something, often reflected in a person's behavior.

Beliefs

The mental acceptance or conviction in the truth or actuality of something, often based on personal interpretation or faith.

Q4: Currently, Brown Corporation (E & P of

Q14: NewCo received all of DebtCo's assets (value

Q21: USCo, a domestic corporation, receives $700,000 of

Q40: What would be the monthly operating advantage

Q57: An affiliated group aggregates its separate charitable

Q59: A taxpayer transfers assets and liabilities to

Q95: For a capital restructuring to qualify as

Q95: The gross estate of Raul, decedent who

Q123: The objectives of setting transfer prices include<br>A)

Q151: The IRS can use § 482 reallocations