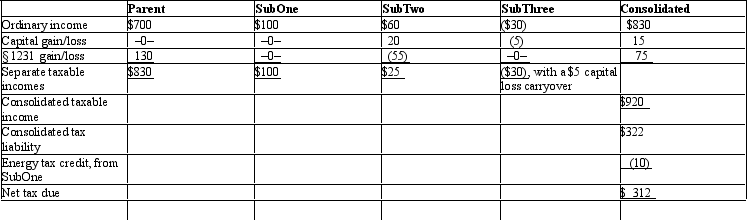

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that the members all have consented to use the relative tax liability tax-sharing method. Dollar amounts are listed in millions, and a 35% marginal income tax rate applies.

Definitions:

Q2: When an affiliated group elects to file

Q3: Under certain circumstances, a distribution can generate

Q5: Gander, a calendar year corporation, has a

Q19: Ann, Irene, and Bob incorporate their respective

Q28: During the year, Blue Corporation distributes land

Q33: The Micro Division of Silicon Computers produces

Q48: Kevin and Nicole form Indigo Corporation with

Q59: A taxpayer transfers assets and liabilities to

Q71: Discuss the influence of step transaction, sound

Q122: If the negative adjustments to the stock