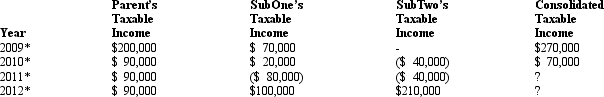

The group of Parent Corporation, SubOne, and SubTwo has filed a consolidated return since 2010. The first two entities were incorporated in 2009, and SubTwo came into existence in 2010 through an asset spin-off from Parent. Taxable income computations for the members are shown below. None of the group members incurred any capital gain or loss transactions during 2009-2012, nor did they make any charitable contributions.

Describe the treatment of the group's 2011 consolidated NOL. Hint: Apply the offspring rule.

* Consolidated return year.

* Consolidated return year.

Definitions:

Your GPA

Your Grade Point Average, a measure of your academic performance calculated on a numerical scale.

Electronic Plain-Text File

A digital file that contains only basic text without any formatting, making it readable by numerous software applications.

Photo

A representation or image captured using a camera that preserves a moment visually, typically in digital or printed form.

Social Media Résumé

A digital version of a traditional résumé that incorporates social media elements and is often shared on social networking platforms.

Q9: The stock of Cardinal Corporation is held

Q19: R & D Storage is a small,

Q24: If the acquiring corporation purchased 25% of

Q25: In terms of the effect of DPAD,

Q40: The AMT exemption amount of $40,000 phases

Q55: Ashley, the sole shareholder of Hawk Corporation,

Q57: A tax avoidance motive is essential in

Q58: Fulton, Ltd., a foreign corporation, operates a

Q62: A shareholder bought 2,000 shares of Zee

Q63: Constructive dividends do not need to satisfy