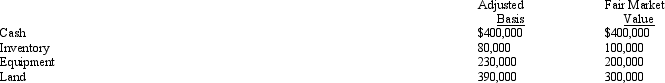

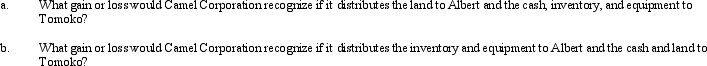

The stock in Camel Corporation is owned by Albert and Tomoko, who are unrelated. Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation. All of Camel Corporation's assets were acquired by purchase. The following assets are to be distributed in complete liquidation of Camel Corporation:

Definitions:

Q13: Ravi Corporation, a calendar year taxpayer, has

Q42: In which type of divisive corporate reorganization

Q43: Manx Corporation transfers 40% of its stock

Q48: Which of the following is a correct

Q87: DPGR cannot include the cost of an

Q95: For a capital restructuring to qualify as

Q111: If subsidiary stock is redeemed or sold

Q120: With respect to income generated by non-U.S.

Q124: Old, Inc., a U.S. corporation, earns foreign-source

Q143: Which of the following taxpayers can be