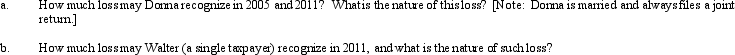

In 2004, Donna transferred assets (basis of $300,000 and fair market value of $250,000) to Egret Corporation in return for 200 shares of § 1244 stock. Due to § 351, the transfer was nontaxable; therefore, Donna's basis in the Egret stock is $300,000. In 2005, Donna sells 100 of these shares to Walter (a family friend) for $100,000. In 2011, Egret Corporation files for bankruptcy, and its stock becomes worthless.

Definitions:

Depository Institutions

Commercial banks and thrift institutions; financial institutions that accept deposits from the public

Customer Deposits

Funds placed by customers with a company, often in the context of financial services, which may be used for further transactions or withdrawn later.

Maximize Profits

The objective of optimizing the difference between total revenues and total costs to achieve the highest possible financial gain.

Board of Governors

A leading body of a central banking system, such as the Federal Reserve in the United States, responsible for overseeing the bank's policies and operations.

Q19: Olga's proprietorship earned a net profit of

Q21: In order to retain the services of

Q44: Income that is included in net income

Q47: ATI = Taxable Income - Adjustments -

Q47: In the current year, Oriole Corporation donated

Q50: Explain how the tax treatment for parties

Q64: Jill has a capital loss carryover in

Q75: Swan Corporation has average gross receipts of

Q75: On January 2, 2011, Orange Corporation purchased

Q96: Modified AGI means AGI without any DPAD