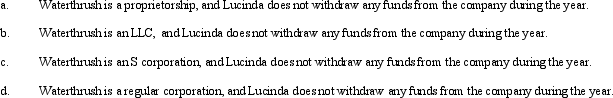

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

Definitions:

Puberty

The period of sexual maturation, during which a person becomes capable of reproducing.

Androgyny

A blend of masculine and feminine characteristics in terms of traits, behaviors, or appearance.

Secondary Sex Characteristic

Physical features that emerge during puberty which are not directly involved in reproduction but distinguish the two sexes from each other.

Spermarche

The commencement of sperm production in boys, marking the onset of puberty and reproductive capability.

Q6: Which of the following is a typical

Q10: Falcon Corporation has $200,000 of current E

Q13: The use of the election to split

Q16: Why is the DPAD benefit somewhat unique?

Q21: In order to retain the services of

Q83: Grebe Corporation was formed in 2000. If

Q86: Penny, Miesha, and Sabrina transfer property to

Q95: The dividends received deduction may be subject

Q107: Which statement is false?<br>A) The starting point

Q121: In a typical estate freeze involving family