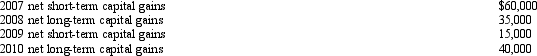

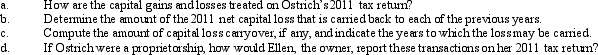

Ostrich, a C corporation, has a net short-term capital gain of $40,000 and a net long-term capital loss of $180,000 during 2011. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

Definitions:

Workforce Inclusiveness

Efforts to create a workplace that welcomes, respects, and values diversity among employees.

Action Planning

The process of identifying specific steps or strategies to achieve goals or objectives.

Optimal Sequence

The most effective or efficient order in which a series of events, actions, or operations can be undertaken to achieve a desired outcome.

Accountable

Being responsible for one’s actions and being prepared to openly discuss and justify them to stakeholders.

Q15: Thomas transfers cash of $160,000 to Grouse

Q22: If a corporation is thinly capitalized, all

Q31: Rust Corporation has accumulated E & P

Q32: The Yellow Trust incurred $10,000 of portfolio

Q38: About _% of all Forms 1040 are

Q55: Ashley, the sole shareholder of Hawk Corporation,

Q74: Income beneficiary Molly wants to receive all

Q75: Nancy, Guy, and Rod form Goldfinch Corporation

Q122: In April 2011, Tim makes a gift

Q168: Mitch pays the surgeon and the hospital