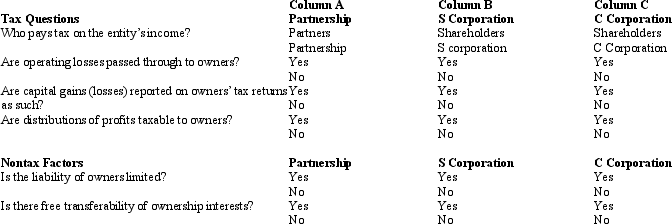

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Definitions:

Unit Product Cost

The total cost associated with manufacturing a single unit of product, inclusive of materials, labor, and overhead.

Net Operating Income

The profit a company has after subtracting its operating expenses from its revenue, excluding interest and taxes.

Absorption Costing

This method of product costing in the field of accounting takes into account all manufacturing-related expenditures, including direct materials, direct labor, and manufacturing overheads, both fixed and variable.

Absorption Costing

An accounting method that captures all of the manufacturing costs (both fixed and variable) in the cost of a product.

Q21: Azul Corporation, a calendar year C corporation,

Q25: Sometimes also known as transaction taxes, Federal

Q39: What are the advantages of § 6166

Q47: ATI = Taxable Income - Adjustments -

Q67: Ivory Corporation, a calendar year, accrual method

Q72: In a § 351 transfer, a shareholder

Q90: Circular 230 requires that a tax preparer

Q107: Which statement is false?<br>A) The starting point

Q118: A CPA, an attorney, and a(n) _

Q119: In making a choice as to which