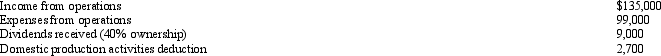

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Great Mosque Damascus

One of the oldest and most significant mosques in the world, located in Damascus, Syria; a key monument in Islamic architecture.

Byzantine

The art, territory, history, and culture of the Eastern Christian Empire and its capital of Constantinople (ancient Byzantium).

Egyptian

Pertaining to the culture, people, or history of Egypt, especially that of ancient Egypt.

Mechanical Timing Relays

Electromechanical devices that operate based on a timer mechanism to open or close contacts after a predetermined time delay. They are used in various applications, including control and automation systems.

Q18: Ben and Lynn are married and have

Q38: The Yellow Trust incurred $10,000 of portfolio

Q40: At one point, the tax rates applicable

Q49: Briefly describe the charitable contribution deduction rules

Q63: Which of the following independent statements correctly

Q67: In 1980, Mandy and Hal (mother and

Q71: Lee, Inc., an S corporation, has taxable

Q73: A taxpayer's return might be selected for

Q82: In computing distributable net income (DNI) for

Q84: A corporation has the following items related