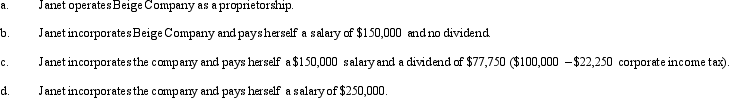

Beige Company has approximately $250,000 in net income in 2011 before deducting any compensation or other payment to its sole owner, Janet (who is single). Assume that Janet is in the 35% marginal tax bracket. Discuss the tax aspects of each of the following arrangements. (Ignore any employment tax considerations.)

Definitions:

Rejection-Then-Retreat Approach

A persuasive technique where an initially larger request is made knowing it will be rejected so that a smaller request (the desired outcome) seems more reasonable.

Reciprocity

A social principle where positive actions lead to similar responses by others, fostering mutual benefit or exchange.

Consensus

General agreement among the members of a group or community.

Framing

The process of presenting or structuring information and issues in a particular way to influence interpretation or decision making.

Q21: Which, if any, of the following is

Q29: Peggy, a trustee, has learned that the

Q32: DPGR - Allowable Indirect Costs = QPAI.

Q45: The Griffin Trust makes a gift to

Q45: One of the objectives of establishing a

Q81: Manfredo makes a donation of $50,000 to

Q94: In the current year, Zircon Corporation donated

Q95: How can a disclaimer by an heir

Q122: How could the § 2513 election to

Q135: In determining the Federal gift tax on