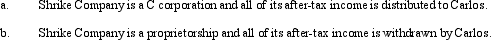

During the current year, Shrike Company had $220,000 net profit from operations. Carlos, the sole owner of Shrike, is in the 35% marginal tax bracket. Determine the combined tax burden for Shrike and Carlos under the following two independent situations. (Ignore any employment taxes.)

Definitions:

Reciprocity

The practice of exchanging things with others for mutual benefit, especially privileges granted by one country or organization to another.

Work Performance

The effectiveness and efficiency with which an individual or group accomplishes their assigned tasks and goals.

Climate

The average weather conditions in a place over a long period, typically used to describe a geographic region's general weather patterns.

Pollution

The contamination of natural environments by harmful substances, resulting from human activities, which negatively affects air, water, soil quality, and consequently, living organisms.

Q6: A negative ACE adjustment is beneficial to

Q7: The grantor set up a trust, income

Q10: Ingrid's projected adjusted gross estate is as

Q12: Which, if any, of the items listed

Q42: In a typical "estate freeze" involving stock:<br>A)

Q56: Which of the following is always personal

Q75: Swan Corporation has average gross receipts of

Q125: The Zhang Trust incurred the following items

Q131: At the time of her death in

Q144: In some cases, the Federal gift tax