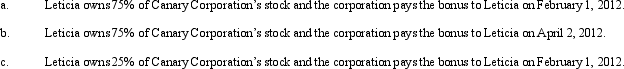

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2011, Canary has accrued a $100,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Under § 267(a)(2), an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income. For purposes of this limitation, a more-than-50% shareholder of the corporation is a related party.

Under § 267(a)(2), an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income. For purposes of this limitation, a more-than-50% shareholder of the corporation is a related party.

Definitions:

Technical Skills

Specific abilities and expertise required to perform particular tasks or jobs, often related to information technology, engineering, or other specialized fields.

Techniques

Methods or procedures used to accomplish a specific task or solve problems in various fields.

Knowledge

Information, understanding, and skills acquired through experience or education; the theoretical or practical understanding of a subject.

New Product

A product that has been recently introduced to the market, offering unique features or improvements over existing products.

Q15: At the time of her death in

Q31: When a trust operates a trade or

Q54: Which, if any, of the following is

Q62: Warren sells property that he inherited five

Q74: Purple Corporation has accumulated E & P

Q77: The Rodriguez Trust generated $100,000 in alternative

Q117: A fiduciary's _ deductions are assigned corresponding

Q123: The deduction for the Goodman Trust's $100,000

Q124: This year, the Nano Trust reported $50,000

Q139: At the time of her death on