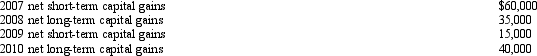

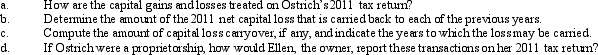

Ostrich, a C corporation, has a net short-term capital gain of $40,000 and a net long-term capital loss of $180,000 during 2011. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

Definitions:

Cognitive Strategies

Techniques or methods that individuals use to process information more effectively, enhance memory, and solve problems.

Natural Environment

The physical world that includes all living and non-living things occurring naturally on Earth, outside of human creations or modifications.

Bystander Effect

The phenomenon in which individuals are less likely to offer help to a victim when other people are present.

Fifth Avenue

A major thoroughfare in Manhattan, New York City, known for its high-end shops and landmarks.

Q20: Trudy forms Oak Corporation by transferring land

Q34: The grantor set up a trust, income

Q39: Rajib is the sole shareholder of Robin

Q58: Isabella and Marta form Pine Corporation. Isabella

Q72: Robert and Kristen are husband and wife.

Q78: Eagle Company, a partnership, had a short-term

Q82: Vireo Corporation, a calendar year C corporation,

Q82: In a letter ruling, the IRS responds

Q106: Red Company, a U.S. corporation based in

Q119: Some of the charitable organizations that qualify