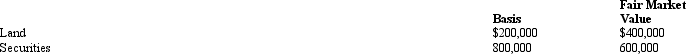

Curt owns the following assets which he gives to his daughter Carla in 2009 (no gift tax results) .  Both items have been held by Curt as an investment for more than one year. If Carla immediately sells these assets for $1 million ($400,000 + $600,000) , she recognizes:

Both items have been held by Curt as an investment for more than one year. If Carla immediately sells these assets for $1 million ($400,000 + $600,000) , she recognizes:

Definitions:

LIFO

"Last In, First Out," an inventory valuation method where the most recently produced or purchased items are the first to be expensed.

Cost Flow Assumption

An accounting principle that determines how costs are allocated to inventory and cost of goods sold, examples include FIFO, LIFO, and average cost methods.

Cost of Goods Sold

The immediate expenses related to the creation of products that a company sells.

Merchandise on Credit

Goods that have been sold but not yet paid for, implying that the buyer owes the seller money.

Q9: Congress has set very high goals as

Q13: Jane is the founder of Citron Corporation

Q31: Junco Corporation is a member of an

Q44: The Drabb Trust owns a plot of

Q79: Beneficiary Terry received $30,000 from the Urgent

Q81: Under common terminology, a unitary group files

Q91: Explain the wages limitation.

Q102: Is a trust subject to the alternative

Q110: With respect to the AMT, what is

Q121: Cruz Corporation owns manufacturing facilities in States