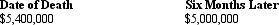

Fred and Pearl always have lived in a community property state. At the time of Fred's prior death in 2011, they held stock that cost them $600,000 but was valued as follows.

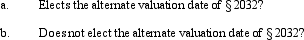

Under Fred's will, his half of the stock passes to their daughter, Brandi. What income tax basis will Pearl and Brandi have in the stock, if Fred's estate:

Under Fred's will, his half of the stock passes to their daughter, Brandi. What income tax basis will Pearl and Brandi have in the stock, if Fred's estate:

Definitions:

Formal Concepts

Abstract ideas or categories defined by a set of rules or characteristics that objects or individuals must possess to be included in the category.

Prototypes

A cognitive representation of a typical member of a category, used to enhance memory and identification by providing examples that epitomize common features within that category.

Representativeness Heuristic

A thinking strategy based on how closely a new object or situation is judged to resemble or match an existing prototype of that object or situation.

Availability Heuristic

A mental shortcut that relies on immediate examples that come to a given person's mind when evaluating a specific topic, concept, method, or decision.

Q13: Patrick, an attorney, is the sole shareholder

Q28: In February 2010, Taylor sold real estate

Q37: The Statements on Standards for Tax Services

Q41: The purpose of the marital deduction is

Q43: The AMT NOL deduction is limited to

Q54: In 2000, Irv creates a revocable trust,

Q93: In his will, Hernando provides for $50,000

Q98: The Roz Trust has distributable net income

Q102: Most states' consumer sales taxes apply directly

Q141: Typically included in the sales/use tax base