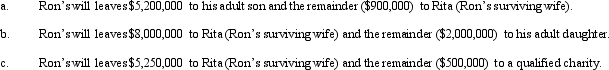

In each of the following independent situations, describe the effect of the disclaimer procedure on Ron's taxable estate. In this regard, advise as to how much should be disclaimed, by whom, and whether a disclaimer should be made. Assume the year involved is 2011.

Definitions:

Benefits Principle

A taxation theory suggesting that people should be taxed based on the benefits they receive from government services.

Progressive Tax

A tax system in which the tax rate increases as the taxable base amount increases, resulting in higher income individuals paying a larger percentage of their income in taxes compared to lower-income individuals.

Vertical Equity

A concept in taxation that argues taxpayers with a greater ability to pay taxes should pay more, compared to those with a lesser ability to pay.

Marginal Tax Rate

The tax rate that applies to the last dollar of the tax base (income or wealth) earned.

Q10: Tax planning usually dictates that high-income and

Q60: Which formula is correct for DPAD?<br>A) Smaller

Q78: Maize Corporation has gross receipts of $3

Q98: The _ tax levied by a state

Q100: Typically exempt from the sales/use tax base

Q121: At the time of his death, Jason

Q140: A _ tax is designed to complement

Q141: Describe the various tax advantages that are

Q148: The taxpayer can avoid a valuation penalty

Q157: An estate tax is a tax on