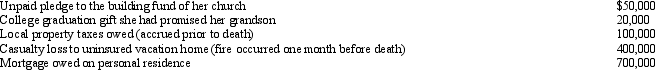

At the time of her death in 2011, Amber owns property worth $4,000,000. Other information regarding her affairs is as follows.

All of these items (except the casualty loss) were paid by her estate and none were deducted on Form 1041 (income tax return of the estate). What is Amber's taxable estate?

All of these items (except the casualty loss) were paid by her estate and none were deducted on Form 1041 (income tax return of the estate). What is Amber's taxable estate?

Definitions:

Phobias

Intense, irrational fears of specific items, creatures, or situations that pose little or no real danger.

Depression

A mood disorder characterized by persistent feelings of sadness, hopelessness, and a lack of interest or pleasure in activities.

Comorbidity

The coexistence of two or more disorders or diseases in the same individual, often complicating the diagnosis, treatment, and prognosis.

Meta-analysis

A statistical technique that combines the results of multiple scientific studies to identify patterns, contradictions, or other insights.

Q20: Regarding the transfer tax credits available, which

Q24: The deferral approach to the estate tax

Q32: What are the chief responsibilities of the

Q53: Leroy, who is subject to a 45%

Q60: Almost all of the states assess some

Q84: Nancy is a 40% shareholder and president

Q92: An exempt organization owns a building for

Q112: Gloria, a calendar year taxpayer subject to

Q115: Which, if any, of the following is

Q118: Harry and Brenda are husband and wife.