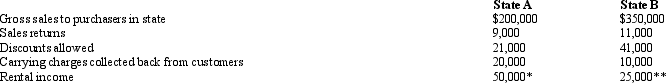

Shaker Corporation operates in two states, as indicated below. All goods are manufactured in State

A. Determine the sales to be assigned to both states to be used in computing Shaker's sales factor for the year. Both states follow the UDITPA and the MTC regulations in this regard.

* Excess warehouse space

* Excess warehouse space

** Land held for speculation

Definitions:

Indirect Approach

A method of addressing a problem or communicating that is not straightforward, often involving subtlety or circumvention.

Well-Written Reasons

Compelling or persuasively articulated arguments or explanations designed to justify or explain a decision or action.

Apologetic

Expressing regret or sorrow for a wrongdoing, mistake, or oversight.

Q14: Mercy Corporation, headquartered in F, sells wireless

Q16: Unrelated debt-financed income, net of the unrelated

Q50: Aaron purchases a building for $500,000 which

Q61: List which items are included in the

Q62: In what manner does the tax law

Q72: Revenue generated by an exempt organization from

Q83: Which of the following statements is correct?<br>A)

Q110: A business organized as a C corporation

Q112: An S corporation must possess the following

Q125: Wally contributes land (adjusted basis of $30,000;