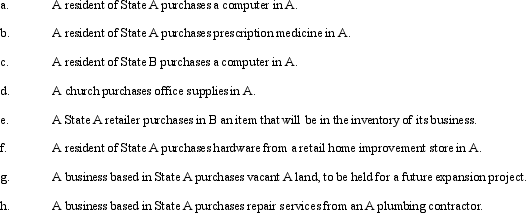

Indicate for each transaction whether a sales (S) or use (U) applies, or whether the transaction is nontaxable (N). Where the laws vary among various states, assume that the most common rules apply. All taxpayers are individuals.

Definitions:

Partnership Capital

The total amount of capital contributed by partners in a partnership, used in the business and subject to changes from profits, losses, and withdrawals.

Capital Balances

Refers to the amount of money that the owners of a company have invested in it.

Goodwill Method

An accounting method used to determine the value of a non-tangible asset acquired when one company buys another.

Profits and Losses

Financial terms representing the positive or negative financial outcomes resulting from a company's operations and activities.

Q9: Giant Corporation owns all of the stock

Q11: Which item does not appear on Schedule

Q15: Roughly forty percent of all taxes paid

Q45: Pauline sells antique furniture to her daughter,

Q49: Peete Corporation is subject to franchise tax

Q78: The IRS periodically updates its list of

Q87: Giselle, a widow, has an extensive investment

Q141: The profits of a business owned by

Q150: Typically, a sales/use tax is applied to

Q151: The Dispensary is a pharmacy that is