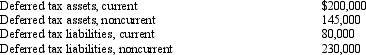

After applying the balance sheet method to determine the GAAP income tax expense of Poppert Inc., the following account balances are found. Determine the balance sheet presentation of these amounts. Hint: Which of the accounts should you combine for the final balance sheet disclosure?

Definitions:

Merchandise Inventory

The total cost of all goods that a company has in stock and available for sale, at any given time.

Merchandise Inventory

The total value of a company's goods that are ready for sale but still in stock, representing a current asset on the balance sheet.

Accounts Payable

A liability in the form of amounts owed by a company to its creditors or suppliers for goods or services received.

Perpetual Inventory System

An inventory system that records changes in inventory levels after every transaction, ensuring continuous, real-time updates.

Q49: A tax preparer can incur a penalty

Q70: Cold, Inc., reported a $100,000 total tax

Q78: The IRS periodically updates its list of

Q82: In a proportionate liquidating distribution, Scott receives

Q87: Nicholas is a 25% owner in the

Q89: After the completion of an audit, the

Q92: For income tax purposes, proportionate and disproportionate

Q94: A limited liability company:<br>A) Could be subject

Q118: Match the following tax forms.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4127/.jpg"

Q127: General Corporation is taxable in a number