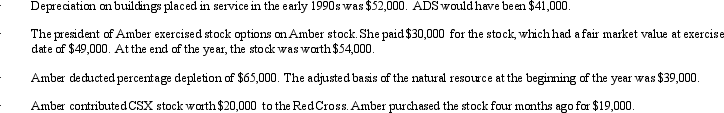

Amber, Inc., has taxable income of $212,000. In addition, Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

Definitions:

Sales on Account

Transactions where goods or services are sold with the understanding that payment will be made at a later date.

Times Interest Earned

A financial ratio that measures a company's ability to meet its interest obligations on outstanding debt from its operating income.

Average Sale Period

The average time it takes for a company to sell its inventory, calculated over a specific time frame.

Total Asset Turnover

A financial ratio that measures a company's ability to use its assets to generate sales revenue.

Q29: A district court must abide by the

Q34: Form 1120S provides a shareholder's computation of

Q40: At the beginning of the year, the

Q57: An exempt entity in no circumstance is

Q75: Schedule M-3 of the tax return Form

Q77: Create, Inc., a domestic corporation, owns 100%

Q83: The December 31, 2011, balance sheet of

Q84: Gator, Inc., is a domestic corporation with

Q128: The § 465 at-risk provision and the

Q146: Which statement is false?<br>A) S corporation status