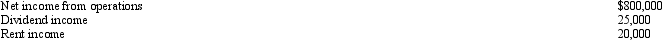

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity. Trout's taxable loss for the current year is $250,000. During the year, Catfish receives a $60,000 cash distribution from Trout. Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Chlorpromazine

The first true antipsychotic medication, introduced in the early 1950s.

Promethazine

A medication used for a range of purposes, including treating allergies, insomnia, and nausea, also serving as a sedative.

Psychiatric Patients

Individuals undergoing treatment for mental disorders, who may receive psychiatric care in various settings.

Lifetime Prevalence

The proportion of individuals in a population who have ever experienced a particular disorder or condition at any time in their lives.

Q18: On January 1 of the current year,

Q26: On August 31 of the current tax

Q29: "Temporary differences" are book-tax income differences that

Q78: Harry and Sally are considering forming a

Q78: Cynthia sells her 1/3 interest in the

Q96: A typical state taxable income addition modification

Q103: Radio, Inc., an exempt organization, trains disabled

Q109: Section 1244 ordinary loss treatment is available

Q115: Which of the following activities is not

Q128: The § 465 at-risk provision and the