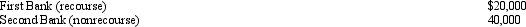

Bart contributes $160,000 to the Tuna Partnership for a 30% interest. During the first year of operations, Tuna has a profit of $30,000. At the end of the first year, Tuna has outstanding loans from the following banks.  What is Bart's at-risk basis in Tuna at the end of the first year?

What is Bart's at-risk basis in Tuna at the end of the first year?

Definitions:

Treasury Shares

Stocks that the original issuing company repurchased, subsequently decreasing the quantity of available shares in the market.

Percent Ownership

The percentage of an entity or asset owned by an investor or company, often determining the level of control or influence.

Excess Acquisition-Date Fair Value

Refers to the amount by which the fair value of the acquired net assets exceeds the purchase consideration in a business combination.

Q5: Why does stock redemption treatment for an

Q7: Third Church operates a gift shop in

Q27: Which one of the following statements regarding

Q43: Kaylyn is a 40% partner in the

Q46: Parent and Junior form a non-unitary group

Q64: In unitary states, a(n) _ provision permits

Q94: An ad valorem property tax is based

Q98: Hope, Inc., an exempt organization, owns a

Q114: Walter wants to sell his wholly-owned C

Q130: Liabilities affect owners' basis differently between a