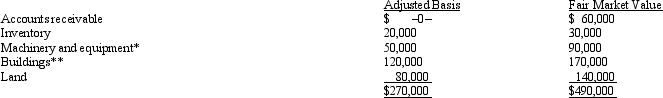

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Correlation

A statistical measure that indicates the extent to which two or more variables fluctuate together.

Simultaneous Change

The occurrence of two or more changes at the same time, often within the same system or process.

Causation

Cause-and-effect linkage between two factors, where one of them causes the other to occur or change.

Cause-and-effect

A relationship where one event (the cause) makes another event happen (the effect).

Q7: Third Church operates a gift shop in

Q9: Molly is a 40% partner in the

Q12: In the sale of a partnership, does

Q21: Aubrey has been operating his business as

Q24: A Revenue Ruling is a legislative source

Q30: Aaron owns a 30% interest in a

Q65: Revenue Rulings carry the same legal force

Q87: Which of the following is an election

Q99: Nontax factors are less important than tax

Q128: For purposes of the unrelated business income