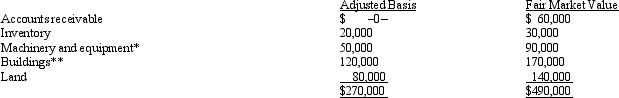

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Rate of Return

The upward or downward movement in the value of an investment through a given timeframe, expressed as a percentage of the investment's initial cost.

Invests

Assigning financial resources with the goal of achieving returns or profit.

Granddaughter

A female grandchild, being the daughter of one's son or daughter.

Compound Interest

Interest calculated on both the original amount of money either loaned or deposited, as well as on the interest that has already been added to it from earlier periods.

Q5: List some of the separately stated items

Q13: William is a general partner in the

Q20: Regulations may first be found in:<br>A) Federal

Q21: An S corporation may be subject to

Q67: A $50,000 cash tax savings that is

Q72: How is the tax law affected by

Q72: Revenue generated by an exempt organization from

Q75: The tax consequences to a donor of

Q83: The December 31, 2011, balance sheet of

Q108: Which of the following statements is correct?<br>A)