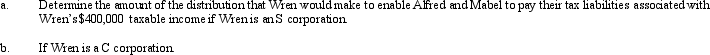

Wren, Inc. is owned by Alfred (30%) and Mabel (70%). Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 33%. Wren's taxable income for 2011 is $400,000.

Definitions:

Osteoporosis

A medical condition characterized by weakened bones, making them fragile and more likely to break.

Breast Self-Exam

A method by which individuals check their own breasts for lumps, changes, or abnormalities to detect breast cancer early.

Pap Smears

A screening test for cervical cancer, involving the collection of cells from the cervix to detect abnormalities that may indicate precancerous or cancerous conditions.

Cervical Cancer

A form of cancer that develops in the cervix from the growth of abnormal cells capable of invading or spreading to various other body parts.

Q13: An activity is not an unrelated trade

Q15: ABC, LLC is equally-owned by three corporations.

Q21: Define a qualified corporate sponsorship payment.

Q28: Victor is a 40% owner (member) of

Q51: An S corporation is limited to _

Q56: In a courtroom challenge, the burden of

Q77: In conducting multistate tax planning, the taxpayer

Q95: When the taxpayer has exposure to a

Q111: Tan, Inc., a tax-exempt organization, has $65,000

Q124: Post-termination distributions that are charged against OAA