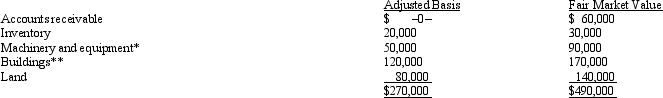

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Self-Esteem

The subjective evaluation or appraisal of one's own worth, capabilities, and overall value.

Prejudices

Preconceived opinions that are not based on reason or actual experience.

Scapegoat Theory

A psychological concept where individuals or groups are unfairly blamed for problems or negative outcomes, often diverting attention from the real causes.

Negative View

An attitude or perspective that emphasizes the bad or undesirable aspects of something.

Q37: The amount of a partnership's income and

Q43: Explain the Golsen doctrine.

Q48: If an individual contributes an appreciated personal

Q49: Shelby, a partner in the STU partnership,

Q61: List which items are included in the

Q77: Which of the following is correct regarding

Q81: Jamie contributed fully depreciated ($0 basis) property

Q102: Describe how an exempt organization can be

Q137: Of the corporate types of entities, all

Q141: Straight debt issued in an S corporation