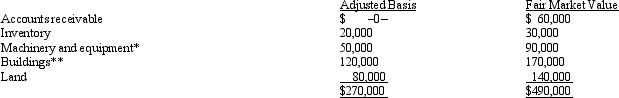

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Long Text

A text field type in databases or forms that allows for the input and storage of lengthy text entries, accommodating more detailed information than standard text fields.

Variable Amount

Refers to a quantity that can change or vary depending on certain conditions or inputs.

Characters

In computing, characters refer to letters, numbers, and symbols that can be input, displayed, or manipulated.

Work Area

A designated space, either physical or digital, where tasks and activities related to work are performed.

Q32: Wren, Inc. is owned by Alfred (30%)

Q53: Usually a business chooses a location where

Q62: What is a feeder organization? How is

Q67: In most states, a taxpayer's income is

Q75: Factors that should be considered in making

Q77: Match the following statements.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4127/.jpg" alt="Match

Q90: Which, if any, of the following items

Q106: Personal property rental income is subject to

Q121: Cruz Corporation owns manufacturing facilities in States

Q140: Which of the following statements regarding a