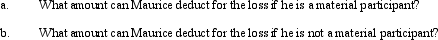

Maurice purchases a bakery from Philip for $410,000. He spends an additional $150,000 (financed with a nonrecourse loan) updating the bakery equipment. During the first year of operations as a sole proprietorship, the bakery incurs a loss of $125,000. Maurice has $300,000 of salary income as the chief financial officer of a publicly-traded corporation. He has interest income of $30,000 and dividend income of $50,000.

Definitions:

Q25: _ describe(s) the degree of business activity

Q48: For an activity to be considered as

Q59: With respect to special allocations, is the

Q65: A corporation can revoke its S status

Q73: Although apportionment formulas vary among jurisdictions, most

Q76: Daisy, Inc., has taxable income of $850,000

Q78: In the "rate reconciliation" of GAAP tax

Q84: Which of the following is not a

Q102: Describe how an exempt organization can be

Q103: C corporations and S corporations can generate