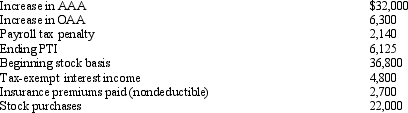

You are given the following facts about a 40% owner of an S corporation, and you are asked to prepare her ending stock basis.

Definitions:

Nonrival

A property of certain goods where one person's consumption does not diminish the availability of the good for others.

Excludable

A property of a good or service wherein it is possible to prevent people who have not paid for it from having access to it.

Social Goods

Goods that benefit all members of society and whose consumption does not reduce their availability to others.

Nonrival

A characteristic of a good whereby its consumption by one individual does not reduce the amount available for consumption by others.

Q8: The AMT statutory rate for C corporations

Q10: Interpret the following citation: 64-1 USTC �¶

Q27: Amber, Inc., has taxable income of $212,000.

Q32: On December 31, 2013, Dixie Corporation has

Q34: In the eliminating/adjusting entries on consolidation working

Q38: The LN partnership reported the following items

Q56: It is easier to satisfy the §

Q75: Which of the following distributions would never

Q95: Anthony's basis in the WAM Partnership interest

Q118: The special allocation opportunities that are available