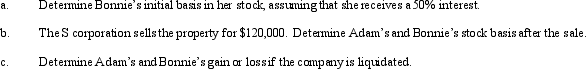

Individuals Adam and Bonnie form an S corporation, with Adam contributing cash of $100,000 for a 50% interest and Bonnie contributing appreciated ordinary income property with an adjusted basis of $20,000 and a fair market value of $100,000.

Definitions:

CEO Positions

Top executive roles within an organization, responsible for making major corporate decisions and managing overall operations.

Canada

A North American country consisting of ten provinces and three territories, known for its vast landscapes and multicultural population.

Female CEOs

Women who hold the chief executive officer position in companies, notable for their leadership in traditionally male-dominated executive roles.

Women Leaders

Female individuals who hold leadership positions, influencing and guiding others within an organization or community.

Q9: For Federal income tax purposes, taxation of

Q17: Unlike determination letters, letter rulings are issued

Q21: An S corporation may be subject to

Q32: Spott is a 75%-owned subsidiary of Penthal.

Q34: Which of the following statements is correct

Q37: Pierce Manufacturing owns all of the outstanding

Q74: Colin and Reed formed a business entity

Q101: Blue, Inc., receives its support from the

Q123: The § 1202 exclusion of gain is

Q138: Assist, Inc., a § 501(c)(3) organization, receives