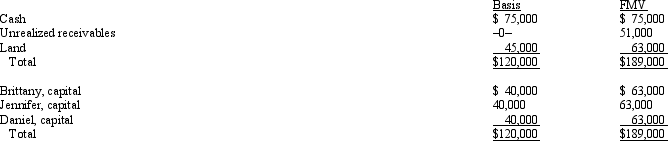

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Definitions:

Femoral Artery

A major artery located in the thigh that supplies blood to the lower quadrant of the body, including the leg and foot.

Urine Output

The volume of urine expelled from the body in a given time, an important indicator of kidney function and hydration status.

Patent Airway

An airway that is open and unobstructed, allowing for effective breathing and ventilation.

Forced Air Warmer

A medical device used to maintain a patient's body temperature during surgery by blowing warm air through a special blanket placed over the patient.

Q1: Grant, a multinational corporation based in the

Q11: Percy Inc. acquired 80% of the outstanding

Q11: Which item does not appear on Schedule

Q21: Tara and Robert formed the TR Partnership

Q26: Plock Corporation, the 75% owner of Seraphim

Q27: Peregrine Corporation acquired an 80% interest in

Q35: On January 1, 2014, Adam Corporation purchased

Q71: If the amounts are reasonable, salary payments

Q92: Rocky and Sandra (shareholders) each loan Eagle

Q98: Hope, Inc., an exempt organization, owns a