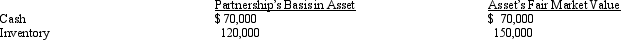

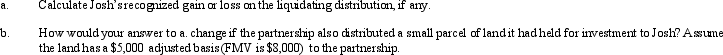

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership. His adjusted basis for his partnership interest on October 15 of the current year is $300,000. On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Definitions:

Prison Population

The total number of individuals incarcerated in a prison system at a given time.

Decreasing Rate

A situation where the rate at which a value or quantity is reduced increases over time.

Canada Savings Bond

A secure investment product offered by the Government of Canada that provides a guaranteed interest rate over a fixed period.

Maturity Value

The total amount payable to an investor at the end of a fixed-term investment, including the principal and the interest.

Q2: One can describe the benefits of ASC

Q12: Purple, Inc., a domestic corporation, owns 80%

Q18: Amos contributes land with an adjusted basis

Q32: Porter Corporation acquired 70% of the outstanding

Q74: A property distribution from a partnership to

Q87: Nicholas is a 25% owner in the

Q96: Hannah sells her 25% interest in the

Q99: Which of the following statements is always

Q115: Which item has no effect on an

Q139: Which statement is incorrect with respect to