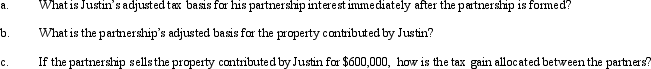

Greg and Justin are forming the GJ Partnership. Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000. The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes. Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Period Costs

Costs that are expensed in the period they are incurred, not directly tied to the production of goods, such as selling, general, and administrative expenses.

Financial Reporting

The process of disclosing financial data and information about a company's performance, financial position, and cash flows, typically in the form of financial statements.

Direct Materials

Components that are directly associated with the creation of a specific product.

Direct Labor

The labor costs directly attributable to the production of goods or services, which includes wages paid to workers who physically produce the product.

Q11: Phauna paid $120,000 for its 80% interest

Q28: Randall owns 800 shares in Fabrication, Inc.,

Q34: Generally, gain is recognized on a proportionate

Q35: Coats for Kids is a private, not-for-profit

Q50: Fern, Inc., Ivy Inc., and Jason formed

Q63: Which court decision is generally more authoritative?<br>A)

Q67: In the current year, Derek formed an

Q76: During the current year, John and Ashley

Q89: Henry contributes property valued at $60,000 (basis

Q131: Some fringe benefits always provide a deduction