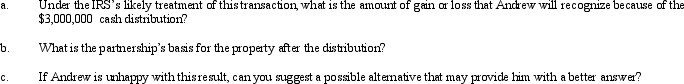

Andrew contributes property with a fair market value of $6,000,000 and an adjusted basis of $2,000,000 to AP Partnership. Andrew shares in $3,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $5,000,000. One month after the contribution, Andrew receives a cash distribution from the partnership of $3,000,000. Andrew would not have contributed the property if the partnership had not contractually obligated itself to make the distribution. Assume Andrew's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Conduction Hearing Loss

Hearing impairment caused by a problem in the outer or middle ear, which interferes with the conduction of sound to the inner ear.

Optic Nerve

The nerve that transmits visual information from the retina to the brain, playing a critical role in vision.

Axons

Long, threadlike parts of nerve cells along which impulses are conducted from the cell body to other cells.

Long Wavelengths

Electromagnetic waves with relatively great lengths, often associated with lower energy and frequency, such as those in radio and infrared spectrum.

Q9: Polaris Incorporated purchased 80% of The Solar

Q17: Oscar Lloyd is serving as the executor

Q22: Which of the following statements is not

Q27: Patterson Company acquired 90% of Starr Corporation

Q32: Temporary Regulations have the same authoritative value

Q35: Coats for Kids is a private, not-for-profit

Q36: Perth Corporation acquired a 100% interest in

Q86: Included among the factors that influence the

Q112: An S corporation must possess the following

Q125: Wally contributes land (adjusted basis of $30,000;