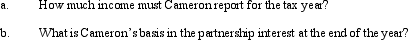

In the current year, the CAR Partnership received revenues of $400,000 and paid the following amounts: $160,000 in rent, utilities, and salaries; a $40,000 guaranteed payment to partner Ryan; $20,000 to partner Amy for consulting services; and a $40,000 distribution to 25% partner Cameron. In addition, the partnership realized a $12,000 net long-term capital gain. Cameron's basis in his partnership interest was $60,000 at the beginning of the year, and included his $25,000 share of partnership liabilities. At the end of the year, his share of partnership liabilities was $15,000.

Definitions:

Sense Of Hearing

The ability to perceive sound by detecting vibrations, changes in the pressure of the surrounding medium through time, through an organ such as the ear.

Bilateral

Involving or relating to two sides; affecting or pertaining to both sides of something.

Pressure Changes

Variations in the force exerted by a fluid or gas on its surroundings, which can affect weather, physical health, and mechanical operations.

Auditory System

The sensory system that includes the ears and the brain structures that process sound.

Q7: An S corporation election for Federal income

Q8: Petrol Company acquired an 90% interest in

Q9: Utah Company holds 80% of the stock

Q10: Peter is going to purchase the assets

Q27: Which one of the following statements is

Q37: At December 31, 2015 year-end, Lapwing Corporation's

Q40: Debt of a limited liability company is

Q68: The earned income tax credit is refundable.

Q68: Rex and Scott operate a law practice

Q114: Walter wants to sell his wholly-owned C